If you want to send someone money quickly, you have many choices. But the two most popular services more people use than any other is PayPal and Venmo.

The main purpose of both is the same: to get money out of your bank account into someone else’s (or the other way around). However, the process of doing so is slightly different between Venmo and PayPal.

Even if you already know everything there is to know about PayPal, you may be wondering: What is Venmo, and is it a better option than PayPal?

What Is Venmo?

Venmo lets you send someone money instantly using either a credit card, a debit card, or your bank account. Many people don’t realize that PayPal actually owns Venmo. Venmo is essentially a simpler, alternative payment service offered by the same company.

Adding Payment Details

Once you sign up for a Venmo account, you’ll just need to add payment methods to start sending or receiving money. You’ll find this in the app menu under Payment Methods.

Just select Add bank or card and fill out the account details in the payment method form.

Once you have a payment added, you’re ready to start using the app.

Sending or Requesting Payments

From the main app screen you can tap the blue Send Payment icon to create a new payment to someone, or request a payment.

The other user will need a Venmo account so that you can search for their name or Venmo user ID to send payment.

You’ll simply need to:

- Select the user you want to send money to

- Enter the amount

- Enter the reason you’re sending the money (optional)

- Set the privacy of the transaction (Prive, Friends, or Public)

- Select Pay (or Request) to request the amount from that person

You’ll see this transaction appear on the main page of the app. You can tap that transaction at any time in the history to view the payment details.

Transfer Money to Your Bank Account

Whenever someone sends you money, you’ll see that appear in your Venmo balance. At any time you like you can tap the Transfer Balance link at the top of the menu to transfer money to your bank account or credit card.

The Transfer Balance page will show your full balance available to transfer. You can do an instant transfer to your bank or credit card for a 1% fee, or allow it to take up to three days with no fee.

Get a Venmo Debit Card

You might have already heard about the Paypal debit card, which lets you access your Paypal funds instantly for payments at any offline or online store.

Now Venmo offers the same feature: the Venmo debit card.

You can sign up for one by tapping Venmo Card in the app menu.

Just work through the wizard to sign up. You can choose from 4 basic colors. It’s a Mastercard debit card so works at mostly any business. It is also a Rewards card so you can earn points every time you use it – and there’s no credit check or monthly fees associated with it.

Venmo vs. Paypal: What Are the Differences?

You may have noticed that Venmo and Paypal have a lot in common. Other than a very different user interface, the two services are very similar.

One of the main differences is Venmo is almost like a payment service and social network combined into one. You can add friends on the service, which makes it more convenient to send or receive payments from them later.

Fees and Charges

There are a number of other differences, some slight and others significant. For example, here are the differences in fees.

- Venmo charges 3% for credit card payments; PayPal charges 2.9% plus a $0.30 fixed charge.

- No fees for bank transfers with either service.

- No fee for debit card payments with Venmo; Paypal charges 2.9% plus a $0.30 fixed charge.

- Venmo has a transaction limit of $4,999.99; Paypal only limits transactions at $10,000.

- Withdrawing money to your bank is faster with Venmo, which only takes 1-3 days. Paypal withdrawals can take from 3-5 days.

Which Is More Accessible?

You can access both services on the same platforms, including the mobile app, or both the mobile or desktop browsers. There is one big difference you’ll notice when you visit Venmo on a browser and log into your account.

You won’t see a Send or Request blue button on the lower right corner like you do in the app. This is because with Venmo, you can only send or request payments using the mobile app.

You can still use the website to review your transaction history, update settings, or request a transfer to your bank account or credit card.

Also, Venmo is only available for use within the United States. On the other hand PayPal is available to people in over 200 countries.

Paypal is also more commonly accepted across many online and offline businesses.

Venmo being much newer, is still getting a foothold.

Being able to pay for things directly in stores using these services means you don’t have to transfer money to your bank account before you can buy things with your balance.

Sending Money to People

Without a doubt, the process of sending money to people with Venmo is much simpler and more streamlined. Using the Venmo app, it’s really just a quick three step process without any confusing options or other choices.

If the user has a Venmo account, you type the amount, a reason (if you want), whether to share the transaction publicly, and you’re done. Your user will have to pay a fee for receiving the money but Venmo doesn’t bother you with those details.

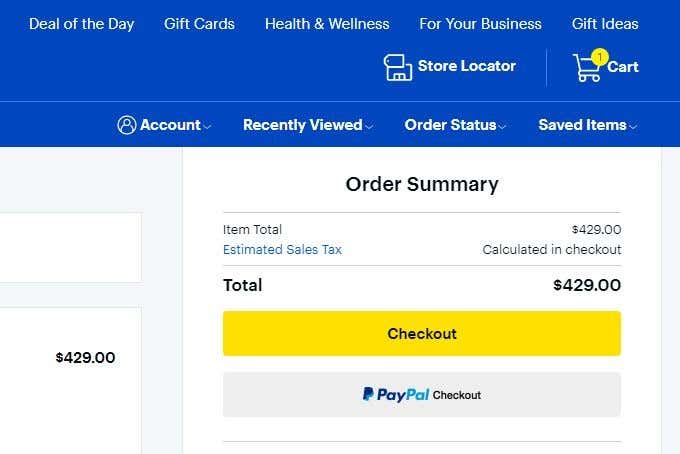

Paypal, on the other hand, has Send, Request, Crypto, and More buttons on the main page, mixed among all kinds of other information cluttered around the main dashboard. It’s also not very easy to find the link to transfer money to your bank or credit card.

And once you do select Send, the process isn’t a simple form. It’s a step by step wizard that changes the next options depending on your choices and who you’re sending money to.

The first step of the wizard looks simple enough.

But then after you select Continue, you’ll see details of the transaction that apparently you can change, like currency, whether you’re Sending to a friend, and what account you’re sending with.

If you choose to change the account, you’ll see you can use your Paypal account or send directly from your bank account.

Why are there so many choices with Paypal while Venmo is such an easy 3-step process?

It’s because Paypal has layered in more complicated fee structures depending on whether payments are international, and what is being paid for.

For example if you’re sending money to a friend you can choose to pay the fee or have the recipient pay it. Or you can choose to pay for goods or services, in which case the recipient has to pay the fee and have it covered by Paypal Purchase Protection.

So, on the one hand, Paypal may offer more features and choices. But Venmo simplifies the entire transaction process by standardizing fees and other details, letting you finish the payment process in just a few, simple clicks.

Other Considerations

A few other important differences to take into account before you make your choice between Venmo vs. Paypal:

- Paypal offers Buyer Protection peace of mind when you’re purchasing from a business.

- Paypal offers business loans.

- You can buy or sell cryptocurrency with Paypal.

In comparing Venmo vs. Paypal, we used two full-membership accounts to examine the user interface, transaction process, features, fees, and balance transfers.

Ultimately, Venmo and Paypal do the same thing. They both get money out of your bank account or credit card and into someone else’s. The difference is that Paypal is a little bit more complicated to use, but offers many more features and services.

Venmo is best for someone who doesn’t want to deal with bells and whistles, and just wants a simple app to send someone some money as quickly and easily as possible.

source https://www.online-tech-tips.com/software-reviews/what-is-venmo-and-why-is-it-better-than-paypal/